Shop Safely Online This Holiday Season (and All Year Long)

Last updated November 29, 2023

Click below to listen to our Consumerpedia podcast episode on how to shop safely this holiday season.

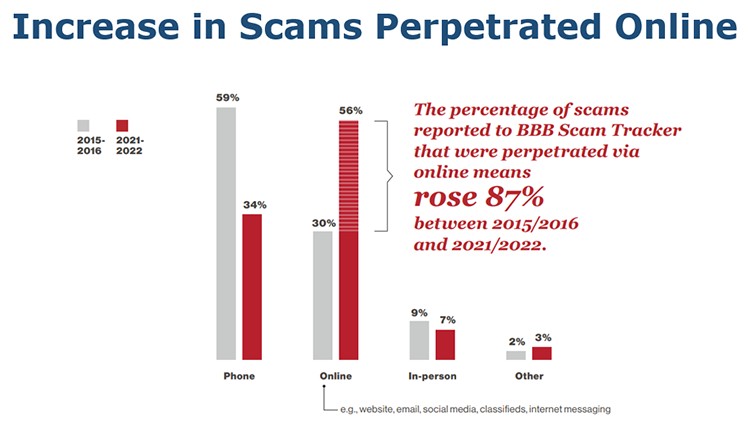

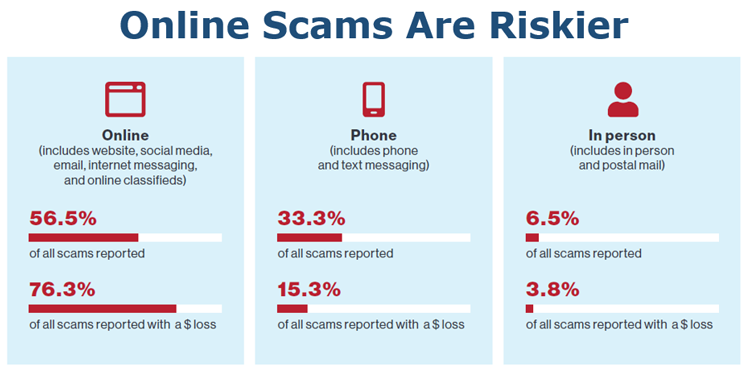

The holiday shopping season is especially lucrative for scammers. While many con artists still call their victims, reports of online scams to the Better Business Bureau have increased by 87 percent since 2015. Even more alarming, BBB Scam Tracker data (see chart below) show that victims of online scams are more likely to lose money.

U.S. consumers reported losing $358 million to online scams last year, according to the Federal Trade Commission.

“These scammers are getting very good, and unfortunately, I don’t think that people’s defenses against them are keeping up,” said John Breyault, a vice president at the National Consumers League, which runs the Fraud.org website.

A common trick is to create fake websites that are often indistinguishable from the real ones. To get you to their copycat bogus sites, scammers run ads on social media offering high-demand items at ridiculously low prices.

“Scammers are trying to reach you on social media through posts of their own, posts that your friends shared, accounts impersonating people you may know, and purchased advertisements,” Breyault said. “If something seems off, don’t dismiss the alarm bells only because you know the person who shared the content.”

Regardless of the pitch, the bad guys are after your personal information, including credit and debit card numbers.

In most cases, the scammers never send anything. Sometimes, they’ll ship counterfeit goods—which can be dangerous—or stolen merchandise.

The BBB surveyed people who reported losing money to online shopping scams. They reported that price was the biggest motivator for making the purchase. If the advertised price is well below the going rate, especially on a popular item, that’s a big red flag.

How to Check Out an Unfamiliar Website

Most of us visit familiar online sites, such as Amazon, Walmart, or Apple. But sometimes, we find ourselves on an unfamiliar retailer’s site. What then?

Before you click on any links or provide any personal or payment information, do some extra work: Search for the company on the BBB website or use the BBB Scam Tracker tool to find out if the site is trustworthy.

“Even a general Google search will bring up things people are saying about a website that you’ve never been to before,” said Melissa Lanning Trumpower, executive director of the BBB Institute for Marketplace Trust.

You can also see how long the site has been around. Be “very, very careful and do some extra due diligence” if the site is brand new, Trumpower advised.

“Scammers are known for putting up websites pretty quickly, they can look really professional, and then they bring them down real fast when they get targeted,” she told Checkbook.

If you decide to make a purchase, use a credit card, so you can dispute the charges if things go wrong.

Why a Credit Card Is the Safest Way to Pay

How you pay matters, especially when you shop online or over the phone. Credit cards provide the most protection. According to federal law, if the merchandise isn’t what you ordered or is damaged—or never arrives— you can dispute the charge, and in most cases, you’ll get your money back.

Debit cards provide some fraud protection, but not as much as credit cards. If you challenge a credit card transaction, you don’t have to pay the disputed amount while the credit card company investigates. When you purchase something with a debit card, the money is automatically withdrawn from your checking account and you won’t have access to those funds while the bank investigates—and that can take weeks. If the bank denies your claim, that money is gone forever.

It’s a huge red flag if a merchant asks you to pay with a peer-to-peer app (such as Zelle, Venmo, or Cash App), gift cards, or cryptocurrency. Don’t do it.

Peer-payment apps warn customers that they should only be used to transfer money to friends, family, or others you know and trust. They are not for shopping online. If you get burned, chances are you will never get your money back.

Watch Out for Delivery Service Impersonators

Delivery scams take place year-round, but they’re a really powerful lure at this time of year. With so much holiday shopping taking place online, it’s easy to let your guard down.

Fraudsters are very good at pretending to be delivery services (UPS, FedEx, DHL, U.S. Postal Service), and major online retailers (Amazon, Apple, Best Buy, Walmart). The bad guys send text and email messages that claim a delivery can’t be completed until you click on the link and provide more information.

The link will take you to a bogus website that mimics the home page of that trusted retailer or package delivery service. While the criminals usually want your personal information, they may also try to convince you to pay a bogus fee to complete the delivery.

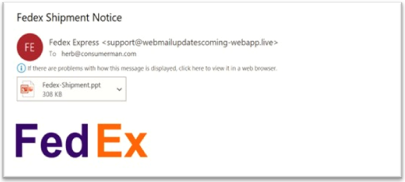

Before replying to an email related to a package delivery, check the sender’s email address. Many scammers use hijacked email accounts and hope you won’t notice. If the email isn’t from the shipper’s domain (such as USPS.com, or FedEx.com) but rather something like DHL@[email protected], that email is from a scammer.

Some of the phishing emails used in package delivery scams contain attachments that appear to be shipping invoices. I received the one below.

Don’t open the attachment and don’t click on the links. That could load malicious software onto your device.

If you are waiting for a delivery, go to the shipment confirmation page on the seller’s or shipper’s website to see if there’s a problem. Never click a link in an email or text message.

Trust Your Gut

The BBB asks people who were targeted by a scammer, but didn’t take the bait, how they avoided losing money. The top response: It didn’t feel right, so they ended the engagement.

“There’s nothing, no transaction or anything, that’s important enough to move forward without doing additional due diligence, or even getting off and talking to a friend about it,” Trumpower said. “If you’re feeling something’s off, just stop and don’t move forward, and that will help protect you.”

If you find yourself tricked by a fraudster, contact the bank or credit card company (or other way you paid) and see if there’s any way to stop the payment or get your money back.

Then, file a report with Fraud.org. Information it collects is shared with a network of more than 200 law enforcement and consumer protection agency partners who investigate these crimes. You should also report the scam on the BBB Scam Tracker to help protect others.

More Info from Checkbook:

- New Law Targets Online Sale of Stolen and Counterfeit Merchandise

- Identity and Cyber Theft: How to Protect Yourself

Contributing editor Herb Weisbaum (“The ConsumerMan”) is an Emmy award-winning broadcaster and one of America's top consumer experts. He has been protecting consumers for more than 40 years, having covered the consumer beat for CBS News, The Today Show, and NBCNews.com. You can also find him on Facebook, Twitter, and at ConsumerMan.com.