Last updated November 2023

Manipulative Marketing Is Now the Norm

30 Tricks Sellers Use to Make You Pay Up and Pay Too Much

Click below to listen to our Consumerpedia podcast episode on misleading marketing tactics.

More than ever, companies are using an arsenal of marketing tricks to manipulate consumers to spend now and spend more. While many of these tactics have been around for centuries, those appeals to pay up have grown increasingly bold and dishonest, often enabled by new technology.

For nearly 50 years, our undercover shoppers have collected more than one million prices for everything from alterations to zucchini from hundreds of types of retailers and service providers—home improvement contractors, auto repair shops, stores selling expensive products, dentists, veterinarians, travel booking sites, grocery stores, and more.

Our research constantly reveals huge company-to-company price differences: Some places charge more than double what their nearby competitors charge for the exact same work or product. One reason for this is that companies know most customers won’t bother to shop around, so they can name their own price. Sometimes consumers don’t compare prices because it’s a pain to scour the internet for the lowest price on a stove or to schedule four or five contractors to bid on a reroofing job. But often we find buyers don’t compare prices because they’ve been duped into thinking they’re getting a great deal.

Here are 30 sneaky pricing and selling strategies to watch out for.

Constant Sales

“SALE! 60% OFF!!”

“List: $299 Our price: $199”

“Special Savings for [insert holiday/excuse]!”

Most retailers constantly advertise big savings. These promotions rarely offer real discounts but are rather attempts to mislead.

Consumers’ Checkbook’s researchers tracked prices of big-ticket items sold at 24 major retailers for 33 weeks. We found that “sales” at 21 of the stores were usually or often bogus, with supposedly lower prices being offered more than half the time. At some stores the fake sales never end: For several chains, we found most items we tracked were offered at a false discount every week or almost every week we checked. In other words, the “regular price” shown on price tags is seldom—if ever—what customers actually pay.

These special-but-not-really-special discounts, holiday sales, and red-dot-spring/summer/whatever events are designed to manipulate you into buying items right away while “on sale” lest you soon face higher prices. It dissuades you from shopping around—after all, if something is “60 percent off,” why compare prices elsewhere? This good-deal euphoria is also designed to make you snap up more stuff while you’re at it.

Federal law states that stores can’t claim to offer items at a discount if the displayed “regular” or “list” prices weren’t offered for a reasonable amount of time. For several years our research has proved that most stores constantly violate the law by displaying dishonest “list” prices that they rarely, if ever, charge. And the practice is growing.

Even if a retailer promises steep savings of 60 percent or more, it’s probably just a marketing gimmick, not a real discount—and likely not the lowest available price. Before buying, shop around; we have advice on the best ways to do that.

Search Results Dominated by Ads

Search for a product on Amazon, Google, Walmart, Target, or Facebook and much of what you’ll get shown is ads. Ditto when using Instacart and restaurant delivery apps.

Although these companies (often too subtly) identify these offers with labels such as “sponsored,” they display so many ads that shoppers are overwhelmed. Google and Facebook have for years existed mostly as advertising vehicles, but now many retailers have shifted from selling stuff to marketing stuff for manufacturers and other advertising clients. We searched for 50 items on Amazon and about half of what we were shown were ads.

Many websites now treat their customers as sales leads for advertisers, rather than customers. They don’t point us toward the best deals or the highest-quality merchandise anymore; instead, we’re pushed to buy from their biggest advertising spenders, making it difficult to shop for the best stuff.

Invading Your Privacy

Most of the selling schemes we describe are sneaky pricing ploys and offers that aren’t as advertised. But marketers increasingly rely on acquiring vast amounts of data from consumers to use in their marketing schemes.

Computer and phone manufacturers, internet service providers, Google and other search services, mapping apps, social media websites, credit card companies, smartphone apps, and retailers relentlessly scoop up information about you. They track web pages you visit, how long you linger on them, and links you click; they keep tabs on what you buy and how much you spend; they access your credit scores; they follow your movements from website to website; they use GPS to record where you travel; they listen in to your conversations using your devices’ microphones; they track who you interact with; and they check on how much you borrow. Even brick-and-mortar retailers use Bluetooth and Wi-Fi beacons to signal when you pass near or enter their stores, and then track your movements. Want the best deal from an online retailer or grocery store? You’ll probably have to join a program that allows the company to grab your data.

Your recorded online life is compiled and sold or traded by thousands of companies, usually with the help of data brokers that are largely unregulated and not required to tell you what they’ve collected or shared.

Data about our private lives constantly fuel a commercial surveillance industry that generates hundreds of billions of dollars each year. The companies that perform or enable all this snooping—Amazon, Apple, Facebook, Google, and Microsoft—are so prevalent and dominant in hardware and software that they’re de facto monopolies. You can’t divorce yourself from them without going off the digital grid.

There’s rarely clear disclosure of what data these companies collect and what they can do with it. When you agreed to its terms of use, did you realize most of the apps on your phone would collect and sell where you traveled every day? Likely not. Plus, many companies are making lots of money buying and selling our data, which are being used in ways we never really agreed to.

Worse, there’s not much we can do to stop it. Digital privacy laws in the U.S. require consumers to take charge of their data and opt out of all this sharing each time they access a new site or download an app. And businesses that collect and sell these data are counting on that not happening.

You might say that this is no big deal. Who cares if companies know you prefer Doritos or tend to buy green shirts and then show you ads for those things? Well, most of these companies’ databases have been breached, meaning criminals also have access to your data, which they can use to prey on you using their own increasingly sophisticated schemes.

And companies are increasingly using our info against us, not just to serve up ads but to decide what to offer us and how much to charge for it. Instead of being treated as customers, we’re increasingly viewed as datapoints that can be sold to other companies.

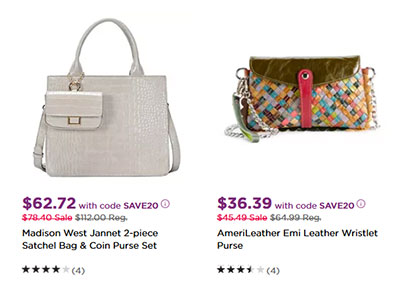

Inflated Anchor Prices

Fake “regular” prices or “anchor” prices enable misleading sales. Most sellers show prices that are crossed out with lower “sale” prices splashed nearby. But these “list” and “regular” prices are rarely if ever charged by the store or its competitors; they’re tricks to make that day’s prices seem like bargains.

Most retailers don’t prominently disclose where anchor prices come from. The ones that offer explanations typically bury them in the “Terms and Conditions” sections of their websites, and usually say “regular” prices are supplied by manufacturers. But some provide even more absurd justifications: The legalese section of Kohl’s website outrageously states: “The ‘Regular’ or ‘Original’ price of an item is the former or future offered price for the item or a comparable item by Kohl’s or another retailer. Actual sales may not have been made at the ‘Regular’ or ‘Original’ prices.”

That’s right: Kohl’s is stating that its competitors might in the future charge the imaginary prices it uses to anchor its misleading “discounts.” Does it own a time machine??!

Like fake sales practices, this is illegal. By law, sellers are prevented from displaying crossed-out “regular” prices if they’re not the retailers’ prevailing prices. Unfortunately, use of fake anchor prices is a standard tactic for many types of businesses now.

Deceptive Patterns

Websites and apps often use tricks to get you to buy things, sign up for services you don’t want, or agree to see more ads. These deceptive designs (also called “dark patterns”) often include confusing wording—for example, alternating the meaning of “on” and “off” when asking users to designate their preferences for receiving future email offers. Another common ploy is to prepopulate web forms to sneakily opt-in customers to agree to let the company collect their data, receive promotional emails, or even pay extra for trip insurance or extended warranties.

Pop-up ads also frequently feature deceptive designs by making it difficult to locate or see a small “X” to get rid of the ad, or position “Close” buttons in odd spots, hoping users will tap on the ad and see the next phase of their pitches, rather than getting rid of the ad.

Online retailers also use dark patterns to illegally upsell their customers. Amazon, for example, automatically enrolls users in its Prime subscription program (which costs $14.99/month or $139/year) if at checkout they click “Continue with Prime delivery” instead of selecting a normal delivery option. Select the top option and there’s no easy way to undo it.

These types of schemes are illegal. In June 2023 the FTC sued Amazon, alleging it enrolls customers in its Prime program without their consent—and then makes canceling difficult. The FTC said Amazon “knowingly duped millions of consumers into unknowingly enrolling in Amazon Prime” for many years.

Bait-and-Switch

Unfortunately, for many services the prices you’re offered are rarely what you’ll actually pay.

Hidden fees cost consumers billions each year. Some of the biggest offenders are hotel- and vacation-booking sites, which in search results churn out per-night rates that don’t include mandatory “resort” and other fees. When our researchers recently checked rates for 75 sample stays at three-, four-, and five-star hotels in major cities, they found that 48 of the 75 hotels charged resort or facility fees, ranging from $2 to $60 per night; on average, mandatory hotel fees added $27 a night to our stays.

Scarcity Warnings

Demand is high! Supply is low! Act quickly or you won’t get that hotel room/pair of sandals/grill. Usually, it’s a ruse to make you buy now.

For example, Consumers’ Checkbook’s researchers spent weeks pricing hotel stays at various travel booking websites. At most sites, we were often warned in search results about sold-out hotels or “Only 1 Left.” The design of each website constantly indicated that unless we booked right away, there would be no rooms at the inns.

Our investigation found these warnings about low availability were dishonest: Most hotels still had plenty of rooms. We conducted 80 searches for hotel stays in major cities across eight websites and all spit out misleading messages. We later repeated these searches three times over three weeks. Each time our shoppers got alerts about nonexistent shortages.

Don’t let these warnings keep you from shopping around. Even if someone else buys that last discontinued sofa, salespeople will find something else to sell you.

Drip Pricing

Similar to bait-and-switch, some companies tout only part of a total price you must pay. For example, cable TV operators might promise new customers low prices of $79 a month, but once they add in fees, taxes, and rental fees for things that should be standard—routers, remotes, DVRs, etc.—you’ll pay $150+ a month.

Airlines’ prices also appear artificially low, since basic economy fares often don’t include baggage fees, carry-on allowances, seat selection, ability to accrue frequent flyer miles, or the right to cancel or change your trip (even for a fee). Carriers use basic economy prices to lure you in before piling on extra charges for basic needs.

People Also Bought…

Salespeople always need something to sell, which is why websites and stores show you stuff related to what you’ve searched to motivate you to keep adding items to your cart.

Price Lineups and Decoys

Most consumers, when presented with a lineup of product models with an array of features and price points, will select one in the middle. Stores often use this tendency to upsell shoppers by showing them seemingly less-desirable or budget options, knowing buyers will likely splurge for a higher-priced model.

Price decoys also nudge shoppers toward higher prices. Retailers often display a significantly more expensive option—say, a $1,700 necklace—right next to a $500 one to make the lower price tag seem more affordable. Apple, for example, does this with its watches: You likely won’t pony up $1,229 or more for one of its Hermès-branded models or even $799 for its top-end “Ultra” model, but those prices make spending $249 or $399 for its basic watches seem like a decent value.

Often when you shop online, search results make it look like products are displayed in a random order. There’s usually nothing random about this; websites are designed to show you a few choices to help you feel good about the price you do pay.

Fake Competition

Many consumers assume they’re enjoying low prices due to fierce competition among Amazon, Walmart, Target, and other mega-retailers, plus easy-to-compare prices using Google and other search engines.

Unfortunately, that’s usually false. There is little price competition for many big-ticket items like appliances, TVs, computers and smartphones, and bikes. That’s because sellers, in collaboration with manufacturers and online search engines, work hard to avoid getting undersold.

One way manufacturers and retailers avoid price wars is by using “minimum advertised price” (MAP) policies, which prohibit retailers from advertising products for prices below preset minimums. If a product’s MAP is $499, that’s the lowest price retailers can advertise. While it’s still worth shopping around, this means there’s little price competition for many products.

Search Google and other search engines for “DeWalt drill best price” and it will show you pricing from multiple retailers that pay it for advertising or placement—but not necessarily tell you about lower prices available from other sellers.

Another way companies with dominant market share present an illusion of competition is by operating several different brands. While it seems like there are dozens of travel-booking websites fighting for your dough—Agoda, Booking.com, Expedia, Hotels.com, Hotwire, Kayak, Momondo, Orbitz, Priceline, Travelocity, Trivago, and many others—most are owned by either Expedia Group or Booking Holdings.

Lack of competition usually means higher prices. Sellers should set their own prices without agreements or constraints.

Worthless Service Contracts, Trip Protection, and Other Add-ons

Shop for a phone, TV, sofa, appliance, vacuum, or dozens of other types of products, and you’ll get urged to shell out for a “protection plan” or “extended warranty.” Book a flight or hotel stay, and you’ll be pushed to “protect your trip.”

To sell these plans, companies prey on our “loss-aversion” tendencies. Most consumers would much rather avoid losing something than pay the same price to replace it: For some reason, losing a $100 bill feels far more painful than buying something for $100. Warning about big risks at checkout creates anxiety and makes us ripe for paying extra to “protect” ourselves.

Consumers’ Checkbook has evaluated these mini “peace of mind” policies, including extended product warranties, travel insurance, rental car coverage, home warranties, and more. We find these plans help their sellers make moolah—the service contracts sold by major retailers typically net them 50 to 70 percent of the selling prices—but don’t provide much value to consumers. Buy insurance to protect against risks that could be financially catastrophic—house fires, auto accidents, medical care—but not to pay for repairs or replacement products you could easily afford.

Poorly Disclosed Paid Endorsements

Endorsements can be highly persuasive, which is why advertisers love them. But to avoid misleading consumers, recommendations should be genuine and honest, and any relationships (such as compensation) between the advertiser and the endorser should be disclosed. Unfortunately, actors, celebrities, musicians, sports figures, and other pitchpeople rarely note they’re being paid to provide seemingly authentic testimonials.

The problem is especially prevalent on social media, where influencers often promote products and services during videos as if they are spontaneous recommendations—not lucrative endorsement deals.

In May 2022, the FTC proposed several revisions to its guidelines that would clarify and strengthen rules for traditional media, plus apply guidelines to cover influencer endorsements on podcasts, social media, and elsewhere. If enacted, the new rules would clarify what qualifies as “a material connection” that needs to be disclosed, and how such disclosures should be made, requiring “clear and conspicuous” disclosures that are “difficult to miss (i.e., easily noticeable) and easily understandable by ordinary consumers.”

The FTC also proposed that celebrities and influencers must disclose any material connection to their advertisers. And if product-review bloggers include affiliate links (which earn them commissions when readers make purchases), that compensation needs to be disclosed, even for independently generated reviews.

Free or Inexpensive Trial Periods

Companies that offer subscriptions often bait their sales hooks with introductory discounts or reduced-cost trial memberships, knowing that once customers sign up they’ll later pay higher rates month after month.

Every year or two, reevaluate your business relationships, particularly your cable and cellphone bills, bank accounts, and credit card accounts to make sure you’re not paying for something you’re not using—or no longer getting the best rate.

For phone, internet, and TV service, you might find your current company now offers a package or plan that provides more for less. Don’t expect the company to offer this voluntarily—be proactive. Call or go to the store and ask: “How can I lower my monthly bill?” If you’ve done your homework—especially if you know a competitor is offering a better deal—you’ll have more bargaining power.

Don’t forget to cancel all the subscriptions you’ve signed up for but no longer use.

Buy Now, Pay Later

If a seller knows its customers will balk at a big price tag, it might offer to split it into smaller installments. You can now find payment plans on shoes, appliances, vacations, and even burritos.

These Buy Now, Pay Later (BNPL) financing offers continue to grow rapidly, pushed by major retailers under partnerships with third-party financing companies including Affirm, Afterpay, Klarna, Pay in 4, PayPal, Sezzle, Shop Pay, and Zip. Not to be outdone, credit card companies now offer BNPL options for certain purchases. All these companies offer what seems like a chance to finance your purchases over time, often without paying interest.

But as the availability of BNPL financing continues to surge, so do delinquency rates among its customers. While these lending products are marketed as smarter ways to pay than using credit cards, borrowers who don’t make payments on time can get hit with costly penalties and damaged credit.

“This is shadow banking at its worst,” said Marshall Lux, a senior fellow at Harvard University who studies these offers. “The fact that it is almost completely unregulated is terrible.”

BNPL financing plans were carefully designed to avoid federal regulation. “The fact that the Truth in Lending Act applies to five payments or more, and the most common form of [BNPL] is four payments, says that someone thought carefully about how to construct this thing,” Lux said. “This is not technically classified as a loan, but, for God’s sake, it’s a loan…and consumers need to be protected.”

Using a BNPL service could make it more challenging to get help if you want to cancel a purchase or are dissatisfied with the merchandise you received. There’s now a third party—the BNPL service—between you and the retailer.

And BNPL does not provide the same legal protections you get when you pay with a credit card. If your purchase is defective or you simply don’t like it, do you deal with the lender or the retailer?

Low-price Guarantees

Many sellers promise to reduce a price if you later find the item for less. But while these promises seem customer-friendly, they often serve only to provide customer confidence in prices, or even cover for a store’s high initial prices.

By Design

Online and brick-and-mortar stores spend millions consulting with behavioral psychologists to get you in the mood to buy. Certain colors and fonts can play huge roles in framing products as affordable or as luxury necessities. Piping in slow or classic tunes makes you linger as you browse; many restaurants play fast-beat music so you’ll chew quickly. Department stores change up flooring materials to slow your gait. Some shops even spray scents formulated to move merchandise. And there’s a reason you have to walk a mile for milk at most grocery stores: You’ll pass impulse items, free samples, baked goods, and other displays designed to make you pause and pick up other stuff.

Non-supermarkets also carefully display products. High-profit items are usually at eye level. And the best bargains are usually right at the entrance to give shoppers the impression that the deals continue deeper into the store.

Free Gifts and Cross Promotions

Marketing pros also take advantage of our loss-aversion tendencies by presenting sales prospects with offers to make customers feel like they’ll lose money or an opportunity if they don’t act. A common ploy is offering “points” or “rewards bucks” for future purchases, rather than discounting the thing you’re buying. Those “gifts” are engineered to put you back in the store, spending money—usually more than the value of the soon-to-expire reward.

Sssshhhh…Just for You

“Because you’ve been a great customer...” “Because we have a crew working nearby…” “Because we have leftover materials…” “Because you’re a parent or a senior…” “Because you belong to the Moose Lodge…” Salespeople know if they can convince you that you’re getting special treatment, you’ll feel good about their offers—and might not shop around.

Loyalty Programs

Airline miles, credit card points and rebates, hotel status tiers, Starbucks stars, platinum-level memberships, school rewards from grocery stores—all are carefully designed to manipulate you into spending often and more, and to foster brand loyalty.

Don’t pass up a great deal just because it’s not offered by your preferred company for accumulating points. Especially in the last few years companies have cheapened their rewards programs, but an easy formula to calculate the value of points is to assume that you’ll earn only a one to five percent rebate for every dollar you spend. So don’t pass up a chance to save $100 by booking with a different airline or hotel due to fretting over lost points. That $100 savings is worth more than the value of even 5,000 points.

Payment Mediums

Many companies have taken a cue from casinos’ use of chips by pushing alternative payment methods. For example, using Starbucks’ app to pay for daily $5 lattes feels like you’re not spending real money.

Retailers also love to sell gift cards. They get to collect money upfront for future purchases, and they tie gift recipients into buying stuff from them rather than the competition.

Perhaps most important to stores: There’s a decent chance the gift card will get lost or forgotten, and the company will realize a near-100 percent profit. It’s estimated that there are about $21 billion in unused gift cards sitting in wallets and dresser drawers nationwide.

Retailers also know customers tend to buy enough stuff to “use up” the full amount on gift cards. Plan your purchases so that your cost stays close to the gifted value.

For a Limited Time Only! Clearance!

Sellers often claim discounts are temporary. Want the lower price? “Act now,” because that deal is only good on Black Friday or end-of-the-year clearance or Presidents’ Day or Valentine’s Day or Memorial Day or Pet Owners Independence Day. But really, there’s no rush: At most stores, the supposedly short-term “discounts” never end.

Don’t assume that “clearance” or “clear out” sales signify amazing deals. We often read advice that claims there’s a best time of the year to buy something because sellers need to clear out old inventory—for example, wait until the end of summer to buy a new grill or lawnmower. These claims generally have no merit—our shoppers find “clearance” items available for the same price from the same sellers months later.

Deadlines show up in other high-pressure sales environments: gyms offering to waive hundreds of dollars in initiation fees if you sign up today; free upgrades that won’t be around after you leave the room or web page.

Salespeople know that if you back off from their offers, you probably won’t return. By setting immediate deadlines, they hope you’ll stop your pesky contemplation and buy already.

Not-So-Independent Referrals

Many companies promise to connect you to the best deals or the best sellers. But these arrangements often exist to serve sellers with sales leads and not necessarily help you find the best products or services or lowest prices.

For example, HomeAdvisor (which also owns Angi, formerly Angie’s List) offers to connect you with “top-rated certified pros in your area.” But it doesn’t provide names of any companies until you provide your street address, phone number, and email address. It then serves up your info to companies that pay it for sales leads—and the resulting emails, phone calls, and texts are often relentless. Are you being connected with the best businesses in the area, or just those willing to pay finders’ fees and commissions to HomeAdvisor/Angi?

Similarly, the automotive section of Consumer Reports’ website displays in its ratings prominent messaging such as “Get price transparency and easily compare offers online.” Not-so-prominently disclosed: These links take you to TrueCar, which makes money by providing sales leads to car dealers. TrueCar partners with CR, AARP, and many other membership groups and companies that get a cut of fees paid by car dealers to TrueCar when their referrals are used to close deals with affiliated dealers.

TrueCar advertises “Car buying at its easiest,” but when we tested it, we found it a miserable experience, with multiple car dealers unleashed on us in a matter of minutes.

TrueCar likely won’t even net you the lowest car price. Although it displays price commitments from participating dealers, we usually find far better deals elsewhere. Click here for the best way to get low prices on new vehicles.

Loss Leaders

Grocery stores excel at advertising a small number of items at steep discounts to make customers think they’re getting low prices. Of course, once you’re in the store you’ll pick up several other things in addition to that BOGO ice cream.

At most other types of retailers, sales are really fake discounts off “regular” prices that you’ll rarely pay. And even legit price reductions are often just a way to get you in the door. Although most Black Friday prices now aren’t really special, some stores still advertise deals like 50 laptops for $199—and perhaps even get some free publicity for it (for some reason, news media treat misleading after-Thanksgiving marketing campaigns as breaking news). But their real strategy is to create the impression that all their prices are super-low, luring you in to buy other items.

Buying in Bulk

We’re conditioned to believe buying in bulk saves money—and sometimes it does. But often buying more means we’ll spend more than planned, or that we’ll waste savings when throwing out 40 fish sticks no one ate.

Even non-warehouse stores motivate buyers to buy in volume. A popular tactic is setting thresholds shoppers must meet to qualify for discounts. If a store offers you an extra $25 in savings if you buy $100 of stuff, you’ll likely keep adding items to your cart to reach that goal.

And retailers know that if they offer pricing at “5 for $25” you’ll buy five of them, even if you can buy just one for $5.

Bundles and Package Deals

Package deals appeal to our tendency to pay one price for several different products or services rather than spring for each thing separately. Vacation packages, for example, are attractive because of their simplicity: In our minds a single all-inclusive price “shrinks” the price of the whole deal, making it seem more affordable.

Online retailers often offer bundles, especially for electronics. Once you’ve agreed to pay $1,500 for a new laptop, you’re easy prey for a docking station, printer, or software. After all, one of these extras will only cost another $100, which is not much money compared to the $1,500 you’re already forking over.

Renewal Discounts

As we detail in our coverage of auto insurance rates, many consumers pay too much for auto insurance (and home insurance) because they stick with the same company year after year. Often, it’s because they think they’re getting big price breaks for their loyalty or claims-free records. But we find most policyholders can save big bucks by shopping for coverage every few years and switching to lower-cost companies.

Prestige Pricing

While some stores and brands offer continuous fake sales, others—usually luxury lines of perfume, luggage, jewelry, etc.—rarely if ever discount anything. This is designed to normalize their high prices. Many luxury brands also de-emphasize money as much as possible. For example, Tiffany’s desktop website doesn’t show you prices until you click on or hover over individual items; Louis Vuitton’s site displays prices in a light font, as if what you’ll pay is unimportant.

Charm Prices

Stores often display prices ending in 99, 98, or 95 to make prices appear lower—$9.99 is perceived as “$9 and change,” rather than $10. It’s actually not the “99” or “95” at the end of the price that affects us—it’s that shoppers pay most attention to the left-most numbers in a price; $199 seems a lot better than $200.

Customers also tend to snap up things priced at random amounts—say “$328.46.” This makes it look as if prices were carefully set to be as low as possible.

Easy Math

Some sellers, especially those with pricey products, advertise discounts as nice round-dollar savings (“Save $100”), rather than as a percentage off. The idea is that you’ll more easily absorb the supposed deal.