Millions of Americans Still Waiting for Stimulus Money; Some Won’t Get It Until Tax Time

Last updated January 11, 2021

More than two-thirds of all the Economic Impact Payments have now been sent out electronically, according to the U.S. Treasury Department. That’s significantly faster than delivery of the first stimulus checks last April. Even so, that leaves millions of Americans still waiting for federal relief.

More than two-thirds of all the Economic Impact Payments have now been sent out electronically, according to the U.S. Treasury Department. That’s significantly faster than delivery of the first stimulus checks last April. Even so, that leaves millions of Americans still waiting for federal relief.

For some, instead of getting a direct deposit payment or check they’ll have to claim their stimulus payments as tax refunds when they file their 2020 tax returns.

Critics say that’s not the speedy relief Congress had in mind when it approved the second round of stimulus payments in late December.

Round two stimulus payments are:

- Up to $600 for singles and up to $1,200 for married couples filing jointly.

- Payments are reduced for individuals with an adjusted gross income in 2019 of more than $75,000 and more than $150,000 for married couples filing jointly.

- Those with dependent children should also receive $600 for each qualifying child under the age of 17.

The IRS advises taxpayers who haven’t received a direct deposit yet to watch their mail for either paper checks or a debit cards. Treasury announced last week that it decided to deliver payments to approximately 8 million Americans by debit card in order to “reach as many people as soon as possible.”

Adding to the confusion: The form of payment this time—check vs. debit card—may be different from the first stimulus payment mailed in the spring.

"Some people who received a paper check last time might receive a prepaid debit card this time, and some people who received a prepaid debit card last time may receive a paper check,” the IRS announced in a news release.

If I get a prepaid card in the mail, how will I know it’s legit and not a scam?

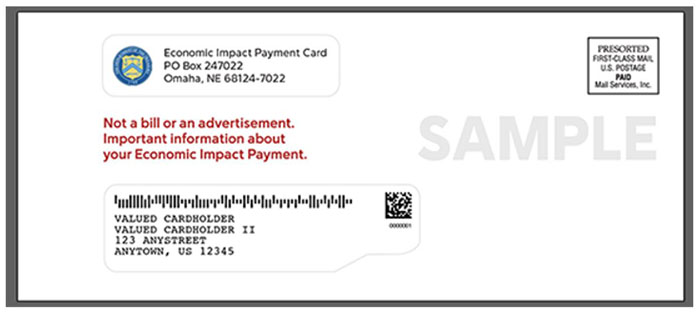

The first Economic Impact Payment debit cards (EIP Cards) were mailed on January 7. They’re in a white envelope that looks like this:

The EIP Card has the Visa logo on the front and the issuing bank, MetaBank N.A., on the back (see image of a sample card, below). Information included with the card will explain that this is your Economic Impact Payment. More information about these cards is available at EIPcard.com.

For those who thought the card was part of a scam and threw theirs out—as happened when debit cards were sent out with the first stimulus payments last spring—can call 800-240-8100 for a free replacement.

Note: Keep the card even after it’s empty, advises the National Consumer Law Center (NCLC). You may be able to use it to quickly receive additional payments if Congress passes another stimulus bill. President-elect Biden is calling on the lawmakers to do that.

Maybe you don’t want a debit card. According to the NCLC, you can’t control how the Treasury sends you the stimulus payment.

If you don’t get the payment and have to claim a rebate on your 2020 tax return, you can specify if you want your refund sent by check or direct deposit.

Problems for Some Who Used a Professional Tax Service Last Year

Some people who had a tax preparation service (such as H&R Block, Jackson Hewitt, or TurboTax) prepare their 2019 return are experiencing another roadblock: If they opted for a quick refund and opened a temporary bank account (whether they realized it or not) to receive payment from the IRS, that account is now closed.

The government can’t send stimulus payments to these accounts, so the deposits are being rejected. The IRS is aware of the problem and says it is working with tax preparation services to redirect the money to the proper accounts.

If you use the Get My Payment tool on the IRS website and get a response that says a direct deposit was sent to an account you don’t recognize, the IRS advises that “this is not an indication of fraud,” and you are advised to monitor your bank accounts.

In a statement released on Friday, the IRS said:

“… the information taxpayers see in the Get My Payment tool, including account numbers and potential deposit dates, many continue to display unfamiliar account numbers as the IRS continues to work through and update this issue. No action is necessary for taxpayers as this work continues; they do not need to call the IRS, their tax provider, or the financial institution.”

Based on industry data from last year, NCLC tells Checkbook that as many as 20 million people may have opened temporary bank accounts through their tax preparer that are now closed.

"It is disappointing that the IRS did not fix this problem, which it has known about for months, in light of the likelihood of a new round of stimulus payments,” said Lauren Saunders, NCLC associate director. “People who need money now may have to wait months until they can file a tax return and get their refund, unless the tax prep companies are able to forward the funds."

UPDATE: It appears that the IRS and many of the major tax preparation services, including TurboTax, H&R Block, and Jackson Hewitt, have resolved the problems for customers who opted for quick refunds. Those customers should receive their stimulus money between now and early February, depending on the company.

Where Is My Money?

To find out, use the Get My Payment tool. It can show you if you the status of your payments for the first and second stimulus payments, including the date the payment was made and the method (direct deposit, or mailed payment).

If you get the message “Payment Status #2—not available,” you’re not being sent any stimulus money, and you will need to claim the Recovery Rebate Credit on your 2020 tax return, if you qualify.

More Info

Visit the IRS website for the latest information on Economic Impact Payments. Its Economic Impact Payment Information Center has detailed answers to topics such as who qualifies for stimulus payments and how to calculate how much to expect.

Contributing editor Herb Weisbaum (“The ConsumerMan”) is an Emmy award-winning broadcaster and one of America's top consumer experts. He is also the consumer reporter for KOMO radio in Seattle. You can also find him on Facebook, Twitter, and at ConsumerMan.com.